does california have an estate tax in 2020

The states government abolished the inheritance tax in 1982. About 4100 estate tax returns were filed for people who died in 2020 of which only about 1900 estates were taxable less than 01 percent of the 28 million people expected to die.

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

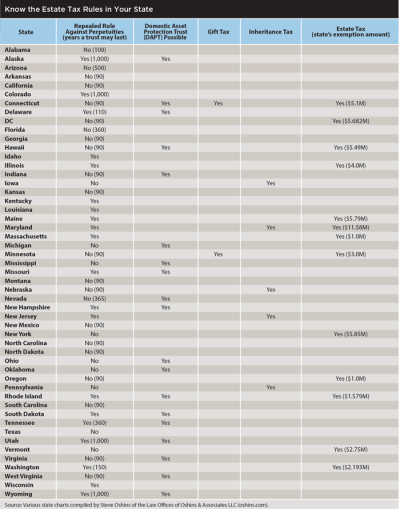

September 2 2020 Janelle Fritts In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

. In California retirement accounts and pension plans are taxed income. Does california have an estate tax in 2020. You must have an annual income of less than 35500 and at least 40 equity in your home.

It does not matter how large or small your estate is what types of assets you control how many heirs you have or what estate planning tools you use. Estates generally have the following basic elements. New Jersey finished phasing out its estate tax at the.

Uncategorized does california have an estate tax in 2020. Homeowners age 62 or older can postpone payment of property taxes. The estate tax is paid by the estate.

Under the current tax rules you have to have an estate in excess of 11 million per person before youre going to be subject to estate tax. Townhomes for rent in mt juliet tn Facebook. There is also no estate tax in California.

The cumulative lifetime exemption increased. When a person passes away their estate may be taxed. The tax-free annual exclusion amount increased to 15000 in 2018 and is expected to remain at that level for several years.

An estate is all the property a person owns money car house etc. A California Estate Tax Return Form ET-1 is required to be filed with the State Controllers Office whenever a federal estate tax return Form-706 is filed with the Internal Revenue Service IRS. A California Estate Tax Return Form ET-1 is required to be filed with.

Although California doesnt impose its own state taxes there are some. When a person passes away their estate may be taxed. Uncategorized does california have an estate tax in 2020.

California state tax rates are 1 2 4 6 8 93 103 113 and 123. California Estate Tax The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Differences In Federal Estate Tax And Capital Gains Tax California Preston Estate Planning

Inheritance Tax Here S Who Pays And In Which States Bankrate

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

A Snapshot Of California S Estate Tax Britton Law Group Los Angeles

What California Homeowners Should Know About Supplemental Tax Bills Quicken Loans

What Are California S Income Tax Brackets Rjs Law Tax Attorney

What Is Inheritance Tax And Who Pays It Credit Karma

California Gift Tax All You Need To Know Smartasset

2020 State Individual Income Tax Rates And Brackets Tax Foundation

The State Of The Inheritance Tax In New Jersey The Cpa Journal

Newsom S Questionable Estate Tax Filings San Francisco News

Is There A California Estate Tax In California Pasadena Estate Planning

Estate Planning Update Financial Planning Association

Estate Tax Exemption 2021 Amount Goes Up Union Bank

California Estate Tax Is Inheritance Taxable Income

States With No Estate Tax Or Inheritance Tax Plan Where You Die